Rehabilitation Equipment Market by Application (Occupational Therapy and Physiotherapy), Product Type, (Daily Living Aids, Mobility Equipment, Exercise Equipment, Body Support Devices), End-User, and Geography – Global Forecast to 2026

- April, 2021

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Rising interest in research and development to develop innovative products with technological advancements fosters the rehabilitation equipment market revenue. The increasing need for efficient and accurate rehabilitation equipment is projected to witness robust development over the coming years. Moreover, favorable reforms in the healthcare sector, promising insurance and reimbursement policies in developed countries are a few factors driving the industry expansion. The rise in frequency of injuries, lifestyle alterations, degenerative diseases, and trauma cases has increased in patients requiring rehabilitation. The growing geriatric population suffering from chronic disorders is significantly contributing to the market development. The Rehabilitation Equipment Market is projected to grow at the rate of 6.36% CAGR by 2026.

Research Methodology:

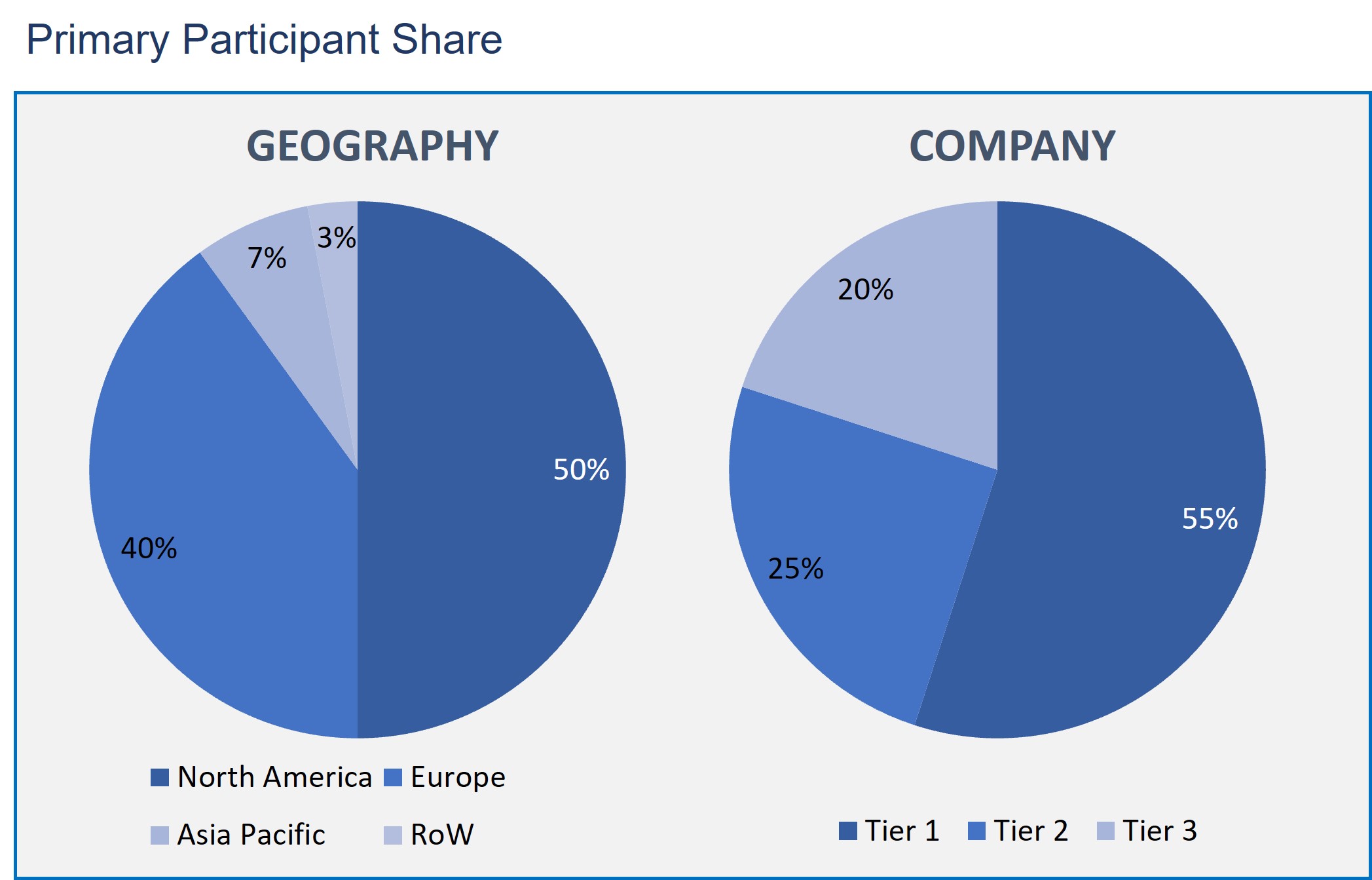

The Rehabilitation Equipment Market Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Rehabilitation Equipment Market is based on Application:

- Occupational Therapy

- Physiotherapy

Rehabilitation Equipment Market is based on End-Use:

- Home Care Settings

- Physiotherapy Centers

- Hospitals & Clinics

- Rehab Centers

Rehabilitation Equipment Market is based on Product Type:

- Body Support Devices

- Patient Lifts

- Medical Lifting Slings

- Exercise Equipment

- Lower Body Exercise Equipment

- Upper Body Exercise Equipment

- Mobility Equipment

- Wheelchairs & Scooters

- Walking Assist Devices

- Daily Living Aids

- Medical Beds

- Bathroom & Toilet Assist Devices

- Reading Writing & Computer Aids

Rehabilitation Equipment Market is based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

The market based on the Product Type is segmented into mobility equipment, body support devices, daily living aids, and exercise equipment. This segment is anticipated to maintain its domination over the estimated period due to the increasing geriatric and handicapped population internationally. The mobility devices segment is supplementarily divided into walking assist devices and wheelchairs & scooter segments. Walking assist devices are the easiest form of mobility equipment preferred by the target population due to their low price and simplicity.

The Application market is segmented into physiotherapy and occupational therapy segments. The physiotherapy segment contains exercise equipment used to rehabilitate patients after trauma or the onset of degenerative diseases. Occupational therapy has a more holistic approach.

The end-use rehabilitation devices market is bifurcated into hospitals & clinics, rehab centers, physiotherapy centers, and home care settings. Hospitals accounted for the highest share of nearly xx% in 2016. Due to the large patient pool of hospitals, this segment is projected to witness substantial growth over the estimated period.

In terms of geography, North America has a substantial base geriatric population. The frequency of non-communicable diseases like cancer, diabetes, arthritis, cardiovascular disease, and Parkinson’s is increasing in this region. Reimbursement programs, like Medicare, are improving access to rehabilitation products.

Key vendors profiled in the report include Invacare Corporation, Medline Industries, Inc, Dynatronics Corporation, Drive Devilbiss Healthcare, Esko Bionics, Caremax Rehabilitation Equipment Ltd, GF Health Products, Inc, Hospital Equipment Mfg. Co, Maddak, Inc, India Medico Instruments.

- The report provides the Rehabilitation Equipment market overall analysis of the market present trends, challenges, and other factors influencing the market growth.

- Research gives the information of every segmentation of the market and the challenges and opportunities.

- The report describes the major market players' profiles and innovations in rendering the services to the end-users.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product Type: Market Size & Analysis

- Overview

- Daily Living Aids

- Medical Beds

- Bathroom & Toilet Assist Devices

- Reading Writing & Computer Aids

- Mobility Equipment

- Wheelchairs & Scooters

- Walking Assist Devices

- Exercise Equipment

- Lower Body Exercise Equipment

- Upper Body Exercise Equipment

- Body Support Devices

- Patient Lifts

- Medical Lifting Slings

- Application: Market Size & Analysis

- Overview

- Physiotherapy

- Occupational Therapy

- End-User: Market Size & Analysis

- Overview

- Hospitals & Clinics

- Rehab Centers

- Home Care Settings

- Physiotherapy Centers

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- GF Health Products, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Caremax Rehabilitation Equipment Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Drive DeVilbiss Healthcare

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Medline Industries, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Hill-Rom Services Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Invacare Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Dynatronics Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- DJO Global, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Carex Health Brands, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Roma Medical

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- GF Health Products, Inc.

- Companies to Watch

- EZ Way, Inc.

- Overview

- Products & Services

- Business Strategy

- EZ Way, Inc.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 2. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR DAILY LIVING AIDS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 3. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR MEDICAL BEDS, BY TYPE, 2020-2026 (USD BILLION)

TABLE 4. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR BATHROOM & TOILET ASSIST DEVICES, BY TYPE, 2020-2026 (USD BILLION)

TABLE 5. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR READING WRITING & COMPUTER AIDS, BY TYPE, 2020-2026 (USD BILLION)

TABLE 6. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR MOBILITY EQUIPMENT, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 7. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR WHEELCHAIRS & SCOOTERS, BY TYPE, 2020-2026 (USD BILLION)

TABLE 8. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR WALKING ASSIST DEVICES, BY TYPE, 2020-2026 (USD BILLION)

TABLE 9. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR EXERCISE EQUIPMENT, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 10. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR LOWER BODY EXERCISE EQUIPMENT, BY TYPE, 2020-2026 (USD BILLION)

TABLE 11. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR UPPER BODY EXERCISE EQUIPMENT, BY TYPE, 2020-2026 (USD BILLION)

TABLE 12. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR BODY SUPPORT DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 13. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR PATIENT LIFTS, BY TYPE, 2020-2026 (USD BILLION)

TABLE 14. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR MEDICAL LIFTING SLINGS, BY TYPE, 2020-2026 (USD BILLION)

TABLE 15. GLOBAL REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 16. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR PHYSIOTHERAPY, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 17. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR OCCUPATIONAL THERAPY, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 18. GLOBAL REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 19. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR HOSPITALS & CLINICS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 20. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR REHAB CENTERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 21. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR HOME CARE SETTINGS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 22. GLOBAL REHAB EQUIPMENT MARKET VALUE FOR PHYSIOTHERAPY CENTERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 23. NORTH AMERICA REHAB EQUIPMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 24. NORTH AMERICA REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 25. NORTH AMERICA REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 26. NORTH AMERICA REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 27. U.S REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 28. U.S REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 29. U.S REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 30. CANADA REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 31. CANADA REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 32. CANADA REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 33. EUROPE REHAB EQUIPMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 34. EUROPE REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 35. EUROPE REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 36. EUROPE REHAB EQUIPMENT MARKET VALUE, END USER, 2020-2026 (USD BILLION)

TABLE 37. GERMANY REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 38. GERMANY REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 39. GERMANY REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 40. U.K REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 41. U.K REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 42. U.K REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 43. FRANCE REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 44. FRANCE REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 45. FRANCE REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 46. ITALY REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 47. ITALY REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 48. ITALY REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 49. SPAIN REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 50. SPAIN REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 51. SPAIN REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 52. ROE REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 53. ROE REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 54. ROE REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 55. ASIA PACIFIC REHAB EQUIPMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 56. ASIA PACIFIC REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 57. ASIA PACIFIC REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 58. ASIA PACIFIC REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 59. CHINA REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 60. CHINA REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 61. CHINA REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 62. INDIA REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 63. INDIA REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 64. INDIA REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 65. JAPAN REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 66. JAPAN REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 67. JAPAN REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 68. REST OF APAC REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 69. REST OF APAC REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 70. REST OF APAC REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 71. REST OF WORLD REHAB EQUIPMENT MARKET VALUE, BY PRODUCT TYPE, 2020-2026 (USD BILLION)

TABLE 72. REST OF WORLD REHAB EQUIPMENT MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 73. REST OF WORLD REHAB EQUIPMENT MARKET VALUE, BY END USER, 2020-2026 (USD BILLION)

TABLE 74. GF HEALTH PRODUCTS, INC: FINANCIALS

TABLE 75. GF HEALTH PRODUCTS, INC: PRODUCTS & SERVICES

TABLE 76. GF HEALTH PRODUCTS, INC: RECENT DEVELOPMENTS

TABLE 77. CAREMAX REHABILITATION EQUIPMENT CO., LTD: FINANCIALS

TABLE 78. CAREMAX REHABILITATION EQUIPMENT CO., LTD: PRODUCTS & SERVICES

TABLE 79. CAREMAX REHABILITATION EQUIPMENT CO., LTD: RECENT DEVELOPMENTS

TABLE 80. DRIVE DEVILBISS HEALTHCARE: FINANCIALS

TABLE 81. DRIVE DEVILBISS HEALTHCARE: PRODUCTS & SERVICES

TABLE 82. DRIVE DEVILBISS HEALTHCARE: RECENT DEVELOPMENTS

TABLE 83. MEDLINE INDUSTRIES, INC: FINANCIALS

TABLE 84. MEDLINE INDUSTRIES, INC: PRODUCTS & SERVICES

TABLE 85. MEDLINE INDUSTRIES, INC: RECENT DEVELOPMENTS

TABLE 86. HILL-ROM SERVICES INC: FINANCIALS

TABLE 87. HILL-ROM SERVICES INC: PRODUCTS & SERVICES

TABLE 88. HILL-ROM SERVICES INC: RECENT DEVELOPMENTS

TABLE 89. INVACARE CORPORATION: FINANCIALS

TABLE 90. INVACARE CORPORATION: PRODUCTS & SERVICES

TABLE 91. INVACARE CORPORATION: RECENT DEVELOPMENTS

TABLE 92. DYNATRONICS CORPORATION: FINANCIALS

TABLE 93. DYNATRONICS CORPORATION: PRODUCTS & SERVICES

TABLE 94. DYNATRONICS CORPORATION: RECENT DEVELOPMENTS

TABLE 95. DJO GLOBAL, INC: FINANCIALS

TABLE 96. DJO GLOBAL, INC: PRODUCTS & SERVICES

TABLE 97. DJO GLOBAL, INC: RECENT DEVELOPMENTS

TABLE 98. CAREX HEALTH BRANDS, INC: FINANCIALS

TABLE 99. CAREX HEALTH BRANDS, INC: PRODUCTS & SERVICES

TABLE 100. CAREX HEALTH BRANDS, INC: RECENT DEVELOPMENTS

TABLE 101. ROMA MEDICAL: FINANCIALS

TABLE 102. ROMA MEDICAL: PRODUCTS & SERVICES

TABLE 103. ROMA MEDICAL: RECENT DEVELOPMENTS

TABLE 104. EZ WAY, INC: PRODUCTS & SERVICES

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.