Minimally Invasive Surgical Instruments Market By Device (Guiding Devices, Inflation Devices, Handheld Instruments, Cutter Instruments, Electrosurgical Devices, Auxiliary Devices, and Monitoring & Visualization Devices), Application, End-Use, and Geography – Global Forecast up to 2026

- April, 2021

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Minimally invasive surgery diminishes the number of incisions completed in surgery to reduce trauma inflicted on the body. This surgery is less painful, causes less scarring, and involves less hospital stay. Constant technological developments, an increase in the frequency of chronic diseases, and intensification in medical tourism in developing countries drive the market's development. But, improper sterilization procedures and inadequate quality assurance related to performance are anticipated to limit the market development. The market is segmented based on product, application, end-user, and geography. The Minimally Invasive Surgical Instrument Market is expected to grow at a 9.2% CAGR by 2026.

Research Methodology:

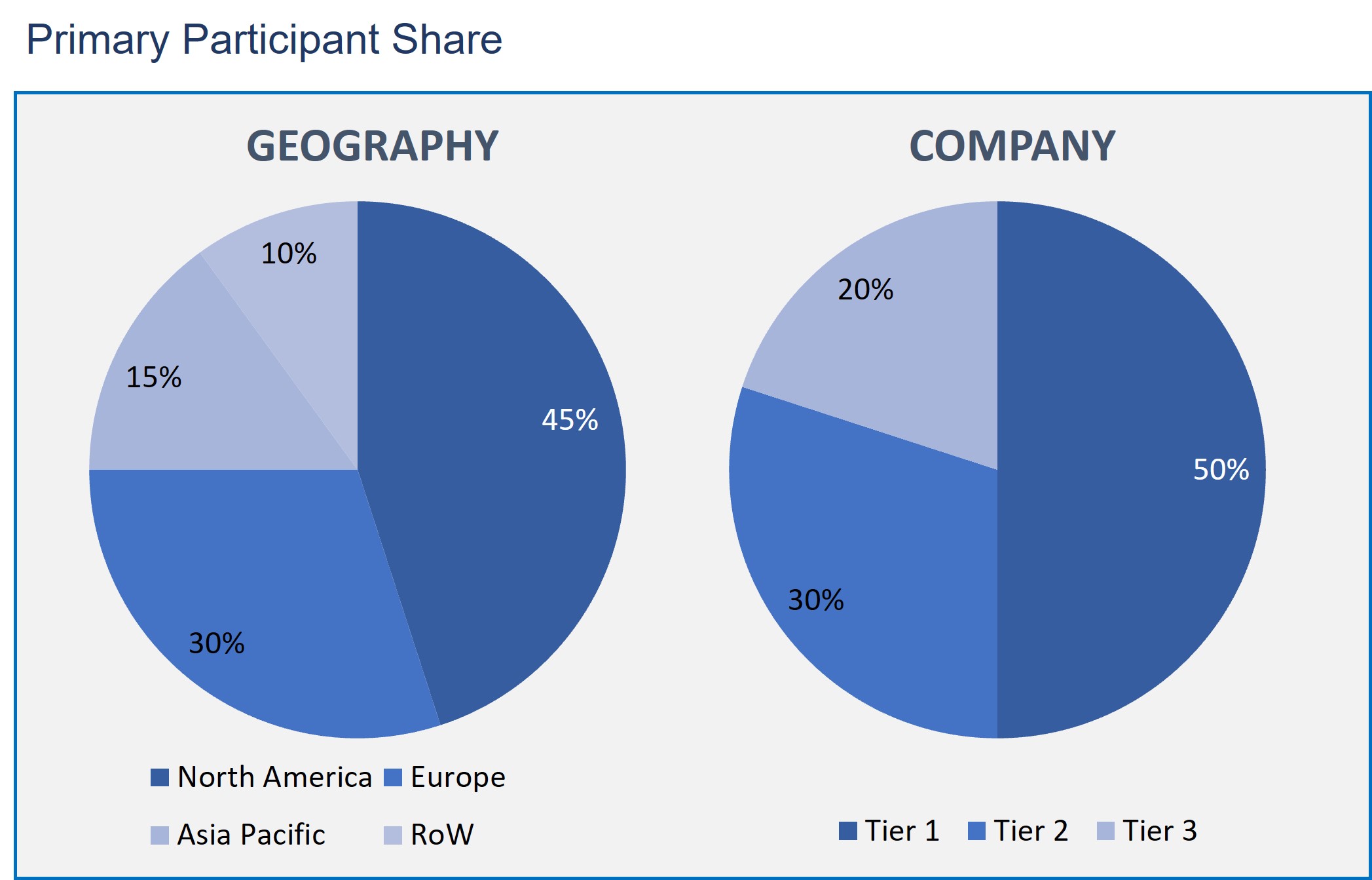

The Minimally Invasive Surgical Instrument Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Minimally Invasive Surgical Instruments Market based on Device

- Handheld Instruments

- Inflation Devices

- Cutter Instruments

- Guiding Devices

- Electrosurgical Devices

- Auxiliary Devices

- Monitoring & Visualization Devices

Minimally Invasive Surgical Instruments Market based on Application

- Cardiac

- Gastrointestinal

- Orthopedic

- Vascular

- Gynecological

- Urological

- Thoracic

- Cosmetic

- Dental

- Others

Minimally Invasive Surgical Instruments Market based on End Use

- Hospitals & Clinics

- Ambulatory Surgical Centers

Minimally Invasive Surgical Instrument Market by Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

On the basis of device, Handheld instruments accounted for the largest share of the MIS instruments market in 2018. This segment's large share can be qualified to the low-cost articulating laparoscopic handheld surgical instruments, development of high-dexterity, and the growing number of surgical procedures.

On the basis of application, the large share of this segment can be qualified to the growing frequency of cardiac diseases, the growing number of coronary and percutaneous cardiology interventions, growing consciousness about the early detection of cardiovascular complications, and growing adoption of MIS instruments.

According to the end-users market, the market has been furcated into hospitals & clinics, and ambulatory centers. The significantly increasing number of end-users for the minimally invasive surgical instruments are ambulatory centers. This is due to the increasing number of ambulatory centers, and these centers provide surgeries to patients at affordable costs compared to hospitals and have higher flexibility of scheduling. Moreover, the increasing trend of outpatient surgeries is also responsible for the segment growth.

North American countries owing to early diagnosis and treatment, high cost of procedures as linked to developing regions, growing number of surgical centers, and increasing adoption of minimally invasive surgical techniques are driving the development of the North American market during the forecast period.

The old population has been rising significantly across the world and is more susceptible to many diseases such as cancer, cardiovascular, stroke, ocular, diabetes, gastric problems, and intestinal problems. Amidst them, the cardiovascular diseases are one of the significant causes of deaths worldwide. Also, stroke is one of the leading causes of death, accounting for 11.13% of the world's total deaths. Thus, the above-mentioned increasing diseases among the old population are accelerating the market growth.

This report gives the profiles of companies leading the Minimally Invasive Surgical Instrument market: Medtronic plc, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, Smith & Nephew plc, Boston Scientific Corporation, and CONMED Corporation.

- This report offers an overall analysis of the Minimally Invasive Surgical Instrument market growth drivers, restraints, opportunities, and other related challenges.

- This report depicts the market developments such as new product launches, mergers and acquisitions, diversification, and joint ventures of the market players.

- This report also describes all potential segments and sub-segments present in the market to help the companies in strategic business planning.

- This report also gives the regional analysis of the Minimally Invasive Surgical Instrument market in terms of market penetration across the world.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Device: Market Size & Analysis

- Overview

- Handheld Instruments

- Inflation Devices

- Cutter Instruments

- Guiding Devices

- Electrosurgical Devices

- Auxiliary Devices

- Monitoring & Visualization Devices

- Application: Market Size & Analysis

- Overview

- Cardiac

- Gastrointestinal

- Orthopedic

- Vascular

- Gynecological

- Urological

- Thoracic

- Cosmetic

- Dental

- Others

- End User: Market Size & Analysis

- Overview

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Koninklijke Philips N.V.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Surgical Innovations Group plc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Smith & Nephew plc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Becton, Dickinson and Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Boston Scientific Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Applied Medical Resources Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Biolitec AG, CONMED Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- The Cooper Companies Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Zimmer Biomet Holdings Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- HOYA Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Koninklijke Philips N.V.

- Companies to Watch

- Abbott Laboratories Inc.

- Overview

- Products & Services

- Business Strategy

- FUJIFILM Holdings Corporation

- Overview

- Products & Services

- Business Strategy

- KLS Martin Group

- Overview

- Products & Services

- Business Strategy

- Abbott Laboratories Inc.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 2. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR HANDHELD INSTRUMENTS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 3. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR INFLATION DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 4. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR CUTTER INSTRUMENTS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 5. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR GUIDING DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 6. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR ELECTROSURGICAL DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 7. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR AUXILIARY DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 8. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR MONITORING & VISUALIZATION DEVICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 9. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 10. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR CARDIAC, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 11. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR GASTROINTESTINAL, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 12. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR ORTHOPEDIC, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 13. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR VASCULAR, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 14. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR GYNECOLOGICAL, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 15. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR UROLOGICAL, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 16. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR THORACIC, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 17. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR COSMETIC, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 18. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR DENTAL, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 19. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 20. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 21. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR HOSPITALS & CLINICS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 22. GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE FOR AMBULATORY SURGICAL CENTERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 23. NORTH AMERICA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 24. NORTH AMERICA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 25. NORTH AMERICA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 26. NORTH AMERICA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 27. U.S MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 28. U.S MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 29. U.S MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 30. CANADA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 31. CANADA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 32. CANADA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 33. EUROPE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 34. EUROPE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 35. EUROPE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 36. EUROPE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, END-USE, 2020-2026 (USD BILLION)

TABLE 37. GERMANY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 38. GERMANY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 39. GERMANY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 40. U.K MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 41. U.K MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 42. U.K MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 43. FRANCE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 44. FRANCE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 45. FRANCE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 46. ITALY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 47. ITALY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 48. ITALY MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 49. SPAIN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 50. SPAIN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 51. SPAIN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 52. ROE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 53. ROE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 54. ROE MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 55. ASIA PACIFIC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 56. ASIA PACIFIC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 57. ASIA PACIFIC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 58. ASIA PACIFIC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 59. CHINA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 60. CHINA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 61. CHINA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 62. INDIA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 63. INDIA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 64. INDIA MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 65. JAPAN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 66. JAPAN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 67. JAPAN MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 68. REST OF APAC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 69. REST OF APAC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 70. REST OF APAC MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 71. REST OF WORLD MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY DEVICE, 2020-2026 (USD BILLION)

TABLE 72. REST OF WORLD MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 73. REST OF WORLD MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 74. KONINKLIJKE PHILIPS N.V: FINANCIALS

TABLE 75. KONINKLIJKE PHILIPS N.V: PRODUCTS & SERVICES

TABLE 76. KONINKLIJKE PHILIPS N.V: RECENT DEVELOPMENTS

TABLE 77. SURGICAL INNOVATIONS GROUP PLC: FINANCIALS

TABLE 78. SURGICAL INNOVATIONS GROUP PLC: PRODUCTS & SERVICES

TABLE 79. SURGICAL INNOVATIONS GROUP PLC: RECENT DEVELOPMENTS

TABLE 80. SMITH & NEPHEW PLC: FINANCIALS

TABLE 81. SMITH & NEPHEW PLC: PRODUCTS & SERVICES

TABLE 82. SMITH & NEPHEW PLC: RECENT DEVELOPMENTS

TABLE 83. BECTON, DICKINSON AND COMPANY: FINANCIALS

TABLE 84. BECTON, DICKINSON AND COMPANY: PRODUCTS & SERVICES

TABLE 85. BECTON, DICKINSON AND COMPANY: RECENT DEVELOPMENTS

TABLE 86. BOSTON SCIENTIFIC CORPORATION: FINANCIALS

TABLE 87. BOSTON SCIENTIFIC CORPORATION: PRODUCTS & SERVICES

TABLE 88. BOSTON SCIENTIFIC CORPORATION: RECENT DEVELOPMENTS

TABLE 89. APPLIED MEDICAL RESOURCES CORPORATION: FINANCIALS

TABLE 90. APPLIED MEDICAL RESOURCES CORPORATION: PRODUCTS & SERVICES

TABLE 91. APPLIED MEDICAL RESOURCES CORPORATION: RECENT DEVELOPMENTS

TABLE 92. BIOLITEC AG: FINANCIALS

TABLE 93. BIOLITEC AG: PRODUCTS & SERVICES

TABLE 94. BIOLITEC AG: RECENT DEVELOPMENTS

TABLE 95. CONMED CORPORATION: FINANCIALS

TABLE 96. CONMED CORPORATION: PRODUCTS & SERVICES

TABLE 97. CONMED CORPORATION: RECENT DEVELOPMENTS

TABLE 98. THE COOPER COMPANIES INC: FINANCIALS

TABLE 99. THE COOPER COMPANIES INC: PRODUCTS & SERVICES

TABLE 100. THE COOPER COMPANIES INC: RECENT DEVELOPMENTS

TABLE 101. ZIMMER BIOMET HOLDINGS INC: FINANCIALS

TABLE 102. ZIMMER BIOMET HOLDINGS INC: PRODUCTS & SERVICES

TABLE 103. ZIMMER BIOMET HOLDINGS INC: RECENT DEVELOPMENTS

TABLE 104. HOYA CORPORATION: FINANCIALS

TABLE 105. HOYA CORPORATION: PRODUCTS & SERVICES

TABLE 106. HOYA CORPORATION: RECENT DEVELOPMENTS

TABLE 107. ABBOTT LABORATORIES INC: PRODUCTS & SERVICES

TABLE 108. FUJIFILM HOLDINGS CORPORATION: PRODUCTS & SERVICES

TABLE 109. KLS MARTIN GROUP: PRODUCTS & SERVICES

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.